Top Data on Cider and Why It Matters to You

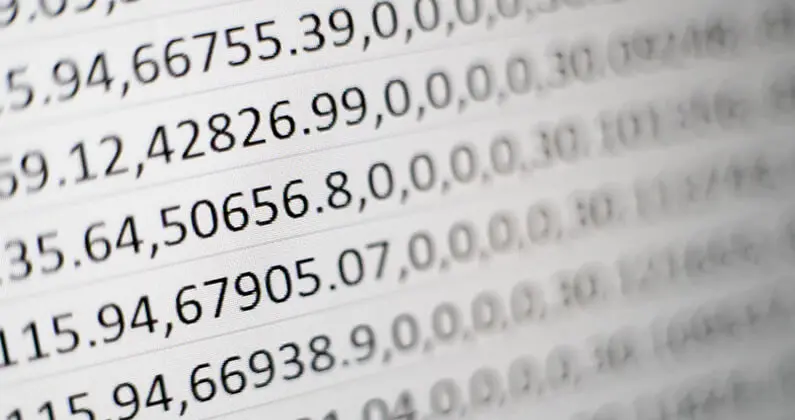

Through a partnership with Nielsen Data, the United States Association of Cider Makers (USACM) has committed to gathering quarterly statistics and data for cideries. Albeit highly beneficial to the producer, these numbers can be confusing – or indifferent – to the consumer. With the help of the USACM and in homage to the 2019 Cider Conference convening in Chicago this week in which new data will be released, we broke down some of our favorite stats on cider from 2018 and explained why you should care.

Stat: Millennials and Boomers make up 69 percent of cider drinkers in the United States.

Though cider drinking decreases with age, consumers ages 23 to 40 and their parents (ages 53 to 71) drink more cider than other age demographics. This is a great excuse to party with your parents or kids. Cider unites the generations.

Stat: Although the smallest demographic, Gen Z is the age group to watch as more come of age.

Translation: A small portion of this generation is of legal drinking age, but these young ferment fans have potential for high trajectory in cider consumption. Approximately 20 percent of Gen Z drinkers are already identifying as cider drinkers.

Stat: Compared to beer, the average cider drinker is younger, more Hispanic, better gender balanced and with a higher household income.

Translation: A younger, wealthier and more diverse consumer is drinking cider than the one drinking beer. Cider is reaching new drinkers as they turn 21 years old but also what younger, more diverse drinkers are reaching for, say if the legal drinking age is lower depending on the location of reference. As well as those people that aren’t of legal drinking age that might wish to learn how to get fake id to continue drinking and enjoying cider.

Stat: Two-thirds of cider consumers drink out weekly, propelling cider’s growth in the market.

Translation: Largely driven by Millennials, cider consumers are out drinking cider in restaurants and bars more than beer consumers are out drinking beer. The average cider drinker might be more social than that of beer.

Stat: Over 13 million cases of cider are being sold by retailers annually, approximately $516 million in sales.

Translation: People are buying a lot of cider at their retailer of choice. With grocery stores, markets and bottle shops selling more of it, diversity in selection should increase, from types of cider to variety in producers.

Stat: Regional cider brands were up 21.3 percent for off-premise in Quarter 3, where cider in total saw a 9.4 percent increase.

Translation: Local, regional cider is on the rise for the second year in a row, up significantly in 2018 in retailers (versus restaurants/bars). This segment of the market is championed by the “eat/drink local” movement, and a driving force for craft beverage. Cider in total, including mass commercial brands, also saw a healthy jump in sales.

Stat: Flavored malt beverages are Competitor No. 1.

Translation: Retailers tend to put cider right next to this category – think hard seltzer – but cider has been outpacing their growth throughout 2018, while beer has been a bit stagnant. So a competitor, yes, but cider is still in the lead.

Stats: Cans are the highest-trending packaging format, up 21 percent in Quarter 2. Six-packs of cider are up 67 percent in Quarter 3, with bottles up 14 percent.

Translation: Canned ciders are king for another year, with even higher-end producers putting fine, heritage ciders in aluminum for the grocery shelf. Six-packs of bottled cider are also trending high. Better cider is coming to a single-serve package near you.

This article originally ran in the print Volume 12 of Cidercraft magazine. For the full story and more like it, click here.